A) The demand deposits of chartered banks are unchanged, but their reserves increase.

B) The demand deposits and reserves of chartered banks both decrease.

C) The demand deposits of chartered banks are unchanged, but their reserves decrease.

D) The demand deposits and reserves of chartered banks are both unchanged.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Lower bond prices reduce interest rates.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to the above market for money diagram. The equilibrium interest rate is:

-Refer to the above market for money diagram. The equilibrium interest rate is:

A) i1.

B) i2.

C) i3.

D) not determinable without further information.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Bank of Canada buys government securities from the chartered banks, which of the following transactions take place?

A) The demand deposits of chartered banks are unchanged, but their reserves increase.

B) The demand deposits and reserves of chartered banks both decrease.

C) The demand deposits of chartered banks are unchanged, but their reserves decrease.

D) The demand deposits and reserves of chartered banks are both unchanged.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Bank of Canada sells government securities to the public, which of the following transactions take place?

A) The demand deposits of chartered banks are unchanged, but their reserves increase.

B) The demand deposits and reserves of chartered banks both decrease.

C) The demand deposits of chartered banks are unchanged, but their reserves decrease.

D) The demand deposits and reserves of chartered banks are both unchanged.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An expansionary monetary policy may be frustrated if the:

A) demand-for-money curve shifts to the left.

B) investment-demand curve shifts to the left.

C) saving schedule shifts downward.

D) investment-demand curve shifts to the right.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the dollars held for transactions purposes are, on the average, spent four times a year for final goods and services, then the quantity of money people will wish to hold for transactions is equal to:

A) four percent of nominal GDP.

B) 25 percent of nominal GDP.

C) nominal GDP multiplied times 4.

D) nominal GDP divided by 25.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the desired reserve ratio is 25 percent and the Bank of Canada buys $4 million of securities from the public. As a result of this transaction the supply of money is:

A) not directly affected, but the money-creating potential of the chartered banking system is increased by $12 million.

B) directly increased by $4 million and the money-creating potential of the chartered banking system is increased by $16 million.

C) directly reduced by $4 million and the money-creating potential of the chartered banking system is decreased by $12 million.

D) directly increased by $4 million and the money-creating potential of the chartered banking system is increased by $12 million.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the quantity of money demanded exceeds the quantity supplied:

A) the supply-of-money curve will shift to the left.

B) the demand-for-money curve will shift to the right.

C) the interest rate will fall.

D) the interest rate will rise.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The two main tools of the monetary policy are:

A) tax rate changes, and the bank rate.

B) open-market operations, and the bank rate & overnight lending rate.

C) tax rate changes, and the changes in government expenditures.

D) changes in government expenditures, and the bank rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In comparison with fiscal policy, monetary policy faces:

A) recognition lag, administrative lag, but avoids operational lag.

B) recognition lag, administrative lag, and operational lag.

C) recognition lag, operational lag, but avoids administrative lag.

D) administrative lag, operational lag, but avoids recognition lag.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

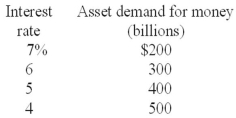

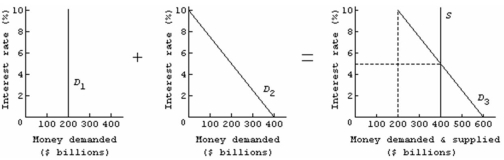

-Refer to the market for money diagram above. Curve D1 represents the:

-Refer to the market for money diagram above. Curve D1 represents the:

A) speculative demand for money.

B) transactions demand for money.

C) asset demand for money.

D) stock of money.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the money GDP is $600 billion and, on the average, each dollar is spent three times per year, then the amount of money demanded for transactions purposes:

A) will be $1800 billion.

B) will be $600 billion.

C) will be $200 billion.

D) cannot be determined from the information given.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When chartered banks borrow from the Bank of Canada, they decrease their excess reserves and their money-creating potential.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will not happen when the Bank of Canada buys bonds from the public in the open market?

A) The desired reserve ratio will increase.

B) The money supply will increase.

C) The deposits of chartered banks will increase.

D) Chartered bank reserves will increase.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Bank of Canada buys bonds on the open market the reserves of chartered banks are:

A) not affected.

B) decreased by a multiple of the amount of the purchase.

C) decreased by the amount of the purchase.

D) increased initially by the amount of the purchase.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the Bank of Canada? It is:

A) a publicly owned and publicly controlled central bank, whose basic goal is to provide income for the Government of Canada.

B) a privately owned and publicly controlled central bank, whose basic goal is to earn profits for its owners.

C) a publicly owned and publicly controlled central bank, whose basic goal is to control the money supply and interest rates and maintain price stability and it is an independent agency of government.

D) a privately owned and publicly controlled central bank, whose basic function is to minimize the risks in chartered banking in order to make it a reasonably profitable industry.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The asset demand for money varies directly with the interest rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Open-market operations" refers to:

A) purchases of stocks in the Toronto Stock Exchange.

B) the purchase or sale of government bonds by the Bank of Canada.

C) central bank lending to chartered banks.

D) the specifying of margin requirements on stock purchases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above graph, in which Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. The transactions demand for money in this market for money is:

A) $125.

B) $175.

C) $250.

D) $325.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 241 - 260 of 376

Related Exams