A) $35,000.

B) $92,000.

C) $41,000.

D) $11,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a partnership makes profit and the accounts are closed,the partner capital accounts will be credited with their designated shares of the profit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keith and Jim are partners.Keith has a capital balance of $50,000 and Jim has a capital balance of $38,000.Bill invested a building worth $30,000 to the partnership for an ownership interest of 20%.How much is the total bonus for the existing partners?

A) $30,000

B) $6400

C) $15,000

D) $8000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Whenever there is a change in the mix of partners,the old partnership is dissolved and a new one begins.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anna and Naomi are partners.Anna has a capital balance of $49,000 and Naomi has a capital balance of $43,000.Gary invested $27,000 to acquire an ownership interest of $23,000.Which of the following is true of the partnership journal entry to record the receipt of Gary's contribution? (Assume the existing partners equally divide the bonus.)

A) Cash is credited for $23,000 and Gary, capital is debited for $23,000.

B) Cash is debited for $23,000 and Gary, capital is credited for $23,000.

C) Cash is credited for $27,000 and Gary, capital is debited for $23,000.

D) Cash is debited for $27,000 and Gary, capital is credited for $23,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The financial statements of a partnership are similar to the statements of a sole proprietorship in all aspects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sasha and Michelle form a partnership.Sasha contributes $19,000 cash and inventory with a current market value of $4000.While journalising this transaction:

A) Inventory will be debited for $4000.

B) Inventory will be credited for $2400.

C) Inventory will be credited for $4000.

D) Inventory will be debited for $2400.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keith and Jim formed a partnership business.The partnership incurs a net loss of $5000 and the partners agreed to share the losses equally.The entry to close the net loss will:

A) decrease Jim, capital by $5000.

B) decrease Keith, capital by $2500.

C) debit Income summary by $5000.

D) increase Jim, capital by $2500.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When a new person wishes to be admitted into an existing partnership that consists of two partners and wishes to obtain an equal share (1/3 share)of the new partnership,the amount that the new person must invest is required to be the average of the capital balances of the existing partners.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When one person purchases the partnership interest of a partner,a new partnership agreement will have to be created.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When one person purchases the partnership interest of a partner,the cash is paid directly to the existing partner,not to the partnership.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In most respects,a balance sheet for a partnership is similar to a balance sheet for a proprietorship EXCEPT for the fact that the equity section shows a capital account for each partner.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Floyd and Merriam start a partnership business on 12 June 2019.Their capital account balances as of 31 December 2020 stood as follows: Floyd agrees to sell off half of his share to Ramelow in exchange for $26,000 cash.Which of the following is the correct journal entry in the books of the firm for the above transfer of interest?

A)

B)

C)

D)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Felix and Ian allocate 2/5 of the profits and losses to Felix and 3/5 to Ian.The net profit of the firm is $40,000.The journal entry to close the Income summary will include:

A) credit to Income summary for $40,000.

B) debit to Felix, capital for $16,000.

C) credit to Ian, capital for $24,000.

D) debit to Felix, capital for $24,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keith and Jim are partners.Keith has a capital balance of $54,000 and Jim has a capital balance of $32,000.Jim sells $11,000 of his ownership to Bill.Which of the following is true of the journal entry to admit Bill?

A) Bill, capital will be debited for $21,000.

B) Bill, capital will be credited for $11,000.

C) Jim, capital will be debited for $21,000.

D) Jim, capital will be credited for $11,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andre,Beau and Caroline share profits and losses of their partnership as 2:3:6.If the net profit is $1,200,000,calculate the profit share of Caroline.

A) $327,273

B) $218,182

C) $109,091

D) $654,545

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a partnership business,George has an ownership of 57% and Ben has an ownership of 43%.For developing the business,they purchased equipment for $9800.George contributes a sum of $6800 and Ben makes a contribution of $3000 on 1 July.Based on the information provided,which of the following is true of the partnership balance sheet?

A) George, capital will increase by $9800 and Ben, capital will remain unchanged.

B) Both George, capital and Ben, capital will increase by $9800.

C) George, capital will increase by $6800 and Ben, capital will increase by $3000.

D) George, capital will increase by $5586 and Ben, capital will increase by $4214.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the process of liquidation,a partnership firm sells its non-cash assets of a book value of $46,000,for $76,000.Which of the following will be included in the entry to record the sale of assets at liquidation?

A) Gain on disposal will be debited by $30,000.

B) Gain on disposal will be credited by $76,000.

C) Gain on disposal will be debited by $76,000.

D) Gain on disposal will be credited by $30,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements describes the situation in which a new person pays a bonus to buy into a partnership?

A) The new person pays a greater amount into the partnership than his or her proportionate share of the total capital.

B) The new partner pays in to the partnership an amount that is less than his or her proportionate share of the total capital.

C) The new person pays certain amounts directly to the existing partners in addition to his or her payment to the partnership.

D) The new partner pays in an amount equal to the average capital balances of the existing partners.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

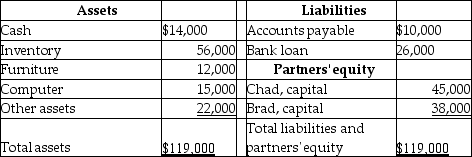

Given below is a balance sheet of Incrad Clothes,a partnership firm,as at 30 June 2017.

With regard to the above table,which of the following statements is true?

With regard to the above table,which of the following statements is true?

A) Brad and Chad have limited liabilities for the partnership's debts because it is a limited liability company.

B) The bank loan of $26,000 is part of the partners' equity.

C) The computer was purchased at a cost less than $14,000.

D) The current market value of the furniture is $10,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 91

Related Exams