A) Dividend preferences

B) Liquidation preferences

C) Call prices

D) Conversion or exercise prices

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shares that have a fixed per-share amount printed on each share certificate are called

A) stated value shares.

B) fixed value shares.

C) uniform value shares.

D) par value shares.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following features of preference shares makes the security more like debt than an equity instrument?

A) Participating

B) Voting

C) Redeemable

D) Noncumulative

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cumulative preference dividends in arrears should be shown in a corporation's statement of financial position as

A) an increase in current liabilities.

B) an increase in equity.

C) a footnote.

D) an increase in current liabilities for the current portion and non-current liabilities for the long-term portion.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In January 2015, Finley Corporation, a newly formed company, issued 10,000 shares of its $10 par ordinary shares for $15 per share.On July 1, 2015, Finley Corporation reacquired 1,000 shares of its outstanding shares for $12 per share.The acquisition of these treasury shares

A) decreased total shareholders' equity.

B) increased total shareholders' equity.

C) did not change total shareholders' equity.

D) decreased the number of issued shares.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A primary source of shareholders' equity is

A) income retained by the corporation.

B) appropriated retained earnings.

C) contributions by shareholders.

D) both income retained by the corporation and contributions by holders.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

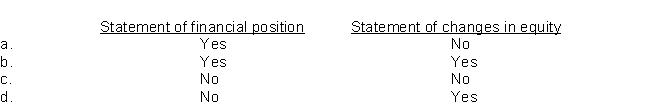

Which of the following is a required statement under IFRS?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the date of declaration of an ordinary share dividend, the entry should not include

A) a credit to Share Capital-Ordinary.

B) a credit to Ordinary Share Dividend Distributable.

C) a debit to Retained Earnings.

D) All of these are acceptable.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following represents the total number of shares that a corporation may issue under the terms of its charter?

A) authorized shares

B) issued shares

C) unissued shares

D) outstanding shares

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When treasury shares are purchased for more than the par value of the shares and the cost method is used to account for treasury shares, what account(s) should be debited?

A) Treasury shares for the par value and share premium for the excess of the purchase price over the par value.

B) share premium for the purchase price.

C) Treasury shares for the purchase price.

D) Treasury shares for the par value and retained earnings for the excess of the purchase price over the par value.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A feature common to both share splits and share dividends is

A) a transfer to earned capital of a corporation.

B) that there is no effect on total equity.

C) an increase in total liabilities of a corporation.

D) a reduction in the contributed capital of a corporation.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A corporation is incorporated in only one country regardless of the number of countries in which it operates.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Many companies pay dividends in amounts equal to their legally available retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cost method records all transactions in treasury shares at their cost and reports the treasury shares as a deduction from ordinary shares.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When preference shares share ratably with the ordinary shareholders in any profit distributions beyond the prescribed rate this is known as the

A) Cumulative feature.

B) Participating feature.

C) Callable feature.

D) Redeemable feature.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If management wishes to "capitalize" part of the earnings, it may issue a

A) cash dividend.

B) share dividend.

C) property dividend.

D) liquidating dividend.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shareholders of a business enterprise are said to be the residual owners.The term residual owner means that shareholders

A) are entitled to a dividend every year in which the business earns a profit.

B) have the rights to specific assets of the business.

C) bear the ultimate risks and uncertainties and receive the benefits of enterprise ownership.

D) can negotiate individual contracts on behalf of the enterprise.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How should a "gain" from the sale of treasury shares be reflected when using the cost method of recording treasury shares transactions?

A) As other income shown on the income statement.

B) As share premium from treasury share transactions.

C) As an increase in the amount shown for share capital.

D) As an increase in the retained earnings amount.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 78 of 78

Related Exams