A) It allows managers to determine the effect of employee labor on departmental profits.

B) It allows managers to predict future labor costs.

C) It is a report designed for external stakeholders.

D) It highlights issues and results of seasonal labor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When journalizing the employees' pay accrual, the ________ is/are the debit(s) , and the ________ is one of the credits.

A) Net pay; gross pay

B) Payroll tax liabilities; gross pay

C) Gross pay; net pay

D) Cash account; net pay

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ is the transferring of information from the General Journal to the General Ledger.

A) Annotating

B) Accruing

C) Posting

D) Computing

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

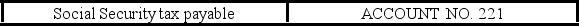

Rushing River Boats has the following data in its Social Security tax payable General Ledger account:

For the entry on January 31, what does the J4 signify?

For the entry on January 31, what does the J4 signify?

A) It is the fourth entry in the General Journal on that date.

B) The transaction appears on page four of the General Journal.

C) It is the fourth repetition of the same entry.

D) The account appears fourth in the list of liability accounts.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which columns might an employer include to facilitate employer-share payroll tax General Journal entries? (Select all that apply.)

A) Worker's Compensation

B) FUTA

C) SUTA

D) Employer's Federal Income tax

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The payroll register contains ________.

A) the employee's name, social security number, and address

B) the name of the firm and the payroll accountant

C) the beginning and ending dates of the pay period

D) the total gross pay, deductions, and net pay during the period

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does a debit balance in the wages and salaries expense account affect a firm's income statement?

A) A debit balance will increase the expenses of the firm's income statement. This will increase the total expenses of the firm and decrease the net income of the firm.

B) A debit balance will decrease the expenses of the firm's income statement. This will increase the total incomes of the firm and decrease the net income of the firm.

C) A debit balance will increase the expenses of the firm's income statement. This will decrease the total expenses of the firm and increase the net income of the firm.

D) A debit balance will increase the income of the firm's income statement. This will increase the total expenses of the firm and increase the net income of the firm.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The General Journal contains records of a firm's financial transactions, which appear chronologically.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

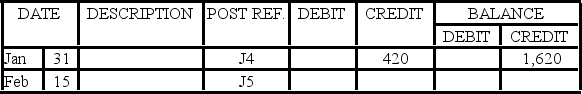

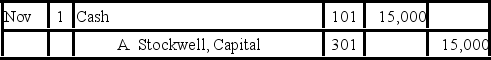

In the following General Journal transaction, to what do the numbers 101 and 301 refer?

A) General journal numbers

B) Employee numbers

C) General Ledger account numbers

D) Transaction numbers

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It is important that the payroll accountant understand the flow of the payroll transactions, especially when working with ________.

A) The payroll register

B) The employee earnings record

C) Accounting software packages

D) Payroll tax reports

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does a payroll accountant keep track of employee's year-to-date earnings for wage bases on taxes like FICA, FUTA, and SUTA?

A) Form W-4

B) Form W-2

C) Payroll register

D) Employee earnings record

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Payroll accruals reflect the amount of payroll paid but not earned at the end of the financial period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following payroll items is not reflected on the income statement?

A) Federal withholding tax payable

B) Health insurance expense

C) Salaries and wages expense

D) Payroll taxes expense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the General Ledger, the debit column reflects the balance of the account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Employee earnings records form the link between accounting and the human resources department.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a liability account?

A) Cash

B) Owners' Capital

C) Salaries Payable

D) Wages Expense

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To which items is information from the payroll register transferred? (Select all that apply.)

A) Employee earnings record

B) General Journal

C) Labor reports

D) Company website

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following reports links the accounting and the human resources departments?

A) Form 941

B) Payroll register

C) Employee earnings record

D) Labor reports

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which report contains employer share tax expenses for a period?

A) The income statement

B) The statement of owners' equity

C) The balance sheet

D) The labor report

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true about the fundamental accounting equation?

A) It must remain in balance at all times.

B) It is always expressed as assets = liabilities - owners' equity.

C) One side of the equation must equal zero.

D) It may be expressed as assets + liabilities = owners' equity.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 72

Related Exams